Performance Highlights FY 2023-24 (Consolidated)

Capitalising on

Growth Opportunities

Growth Opportunities

Financial Indicators

Revenues

from Operations

(` crore)

2020

2021

2022-23*

2023-24

2024-25

EBITDA

(` in crore)

2020

2021

2022-23*

2023-24

2024-25

EBITDA

Margin

(%)

2020

2021

2022-23*

2023-24

2024-25

Profit

Before Tax

(` crore)

2020

2021

2022-23*

2023-24**

2024-25

Profit

After Tax

(` crore)

2020

2021

2022-23*

2023-24**

2024-25

Earnings Per

Share

(`)

2020

2021

2022-23*

2023-24

2024-25

Average Capital

Employed

(` crore)

2020

2021

2022-23*

2023-24**

2024-25

Book Value

Per Share

(`)

2020

2021

2022-23*

2023-24

2024-25

Market Capitalisation**

(` crore)2020

2021

2022-23*

2023-24

2024-25

CSR Expenditure

(` crore)2020

2021

2022-23*

2023-24

2024-25

Operational Indicators

Cement

Sales Volume

(MMT)

2020

2021

2022-23*

2023-24

2024-25

Cement

Production Volume

(MMT)

2020

2021

2022-23*

2023-24

2024-25

*The Company had changed its financial year ending from December 31 to

March 31. FY

2022-23 was for 15 months (January 01, 2022 - March 31,

2023). Therefore, the data for FY 2023-24 and FY 2024-25 is not comparable with the figures for

the 15 months year ended March 31, 2023.

**Restated, refer Note 67(g) of Consolidated Financial Statement

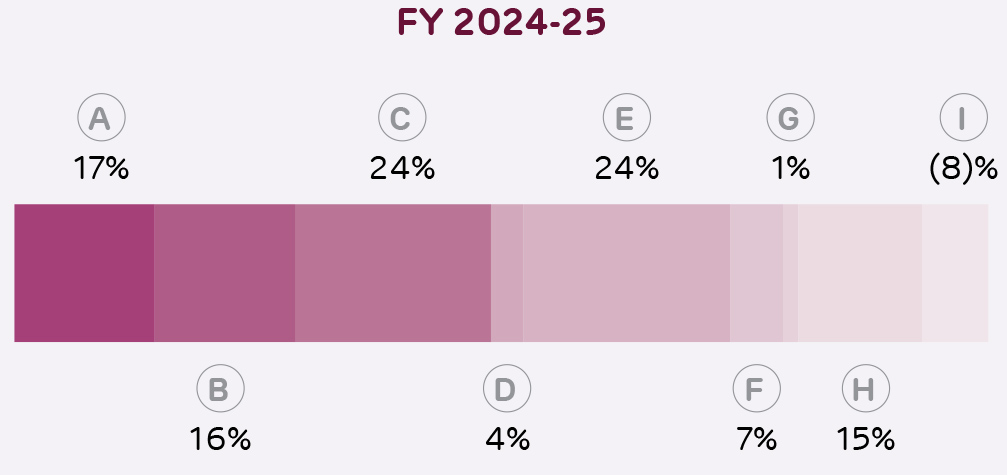

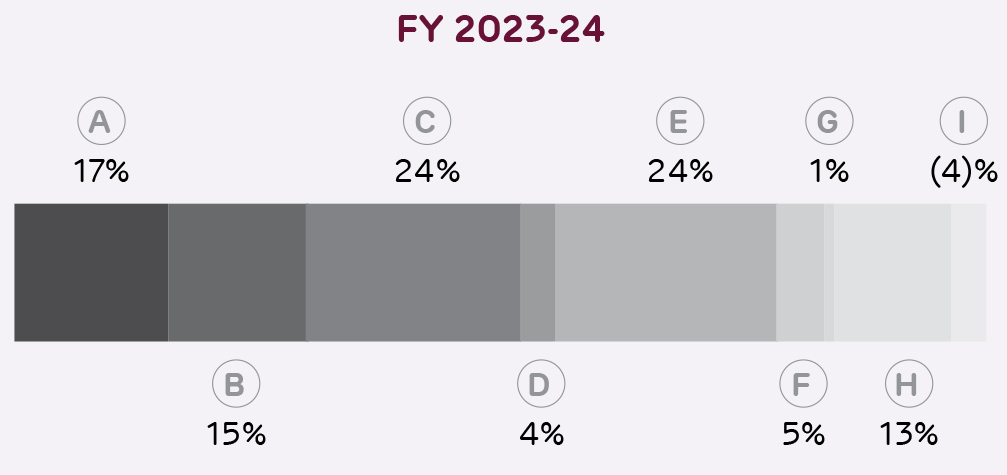

Cost and Profit as a Percentage of Revenue from Operations1

1 Before exceptional items and before share of profit of associates and joint ventures