Staying vigilant

and accountable

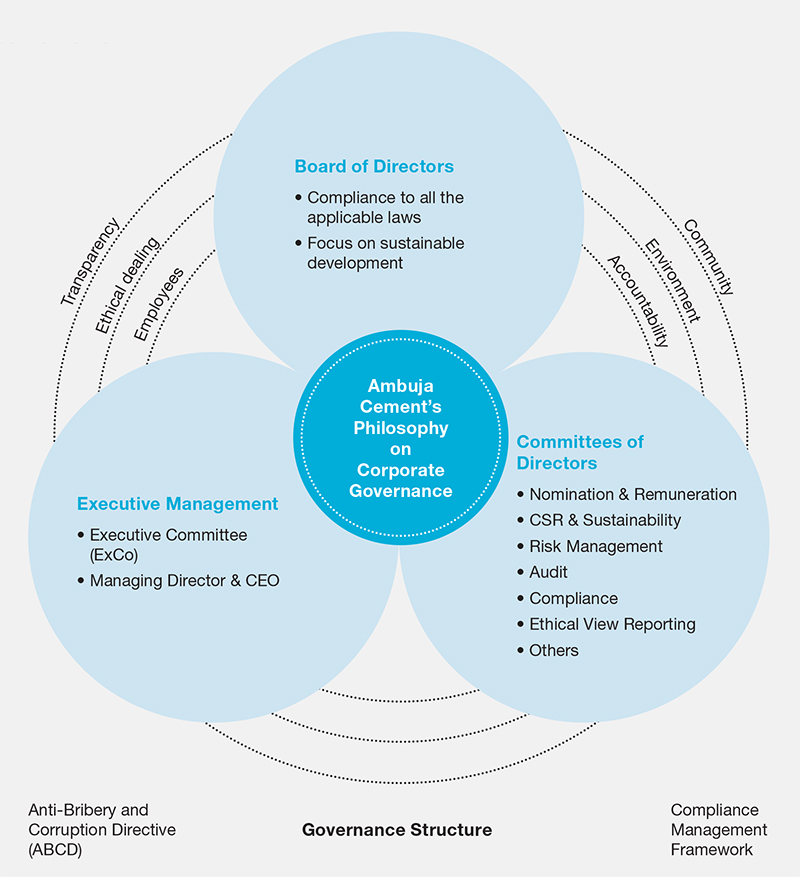

At Ambuja Cement, the Board plays a pivotal role in embedding and sustaining a culture of responsibility

We maintain the highest level of governance standards backed by superior values, ethics and policies. Our corporate governance framework sets on course the principles of responsibility, accountability and transparency in the way we conduct our operations.

Board competence and responsibilities

Ambuja Cement’s Board comprises 15 Directors, 1 Executive and 14 Non-executive Directors, including 5 Independent Directors, 1 Non‑Executive, Non-Independent Female Director and 1 Non-Executive, Independent Female Director (Institutional Nominee), with vast experience in the fields of building products, finance and accounting, strategy, information technology, human resource management, banking and insurance, law and regulations and capital markets, among others.

The Board actively supervises performance with regard to the key strategies of Ambuja Cement, along with other key aspects of operations, including risk management, sustainability and stakeholder relationship, among others. Regular meetings are conducted for the Board to review these practices. Active involvement of the Board is reflected in the average Board meeting attendance of 93% during 2020.

We are among the first corporate organisations in the country to involve Board-level participation for compliance, having formed a committee chaired by one of the Independent Directors.

The Board is regularly updated on the key topics that impact our business. A special meeting is arranged every year with the Board members to review and approve the business plan for the subsequent year, and the Board’s feedback is incorporated in the final plan. The Audit Committee and the Board also review and approve every related-party transaction. Approval of the shareholders is sought wherever needed.

More than 40% of the Board members have been associated with the Company for five years or more, and the average tenure of the Board during 2020 was nine years.

The Directors are regularly familiarised with business processes and updates. The Company initiates interaction with the management of LafargeHolcim to keep the Directors updated about the best practices and key events at the Group level. Details about the familiarisation programme can be accessed on the Company website at www.ambujacement.com/Upload/ PDF/Familiarisation-Programme-for- Independent-Directors-Jan2021.pdf.

One of the key issues of business sustainability is succession planning. The Nomination and Remuneration Committee under the aegis of the Board, is engaged in driving succession planning of Ambuja Cement.

All related-party transactions are entered into on an arm’s length basis and are compliant with the applicable provisions of the Companies Act, 2013 and the Listing Agreement. No materially significant related party transactions, having potential conflict with the interests of the Company at large, have been made by our Promoters, Directors and key managerial personnel among others.

Details of the process to manage related-party transactions are provided on page 138 and the details of the transactions with related parties are provided in the financial statements, forming part of the Annual Report 2020.

The Board takes active interest in Environment, Social and Governance (ESG) issues under various Board committees and takes regular updates on the functioning of each project and specific updates.

Values, ethics and integrity

The Board has laid out a holistic Ethical View Policy (EVP) (akin to the Whistleblower Policy) and Anti-Bribery and Corruption Directive (ABCD) as an extension of its Code of Business Conduct and Ethics, covering the Directors, employees and relevant stakeholders of Ambuja Cement. Our ‘Zero Tolerance’ towards corruption and bribery ensures fair and transparent business dealings and these policies play a pivotal role in eradicating the risks of fraud, corruption and unethical business practices across our business value chain.

The implementation and maintenance of ABCD are monitored stringently by the Audit and Compliance Committees of Directors and are periodically reviewed by the Board.

During 2020, we received 37 complaints, of which 19 complaints were pre-assessed, but did not warrant further investigation. About 17 complaints were investigated and concluded and 1 complaint is still under investigation. The investigated cases were mainly of the nature of kickbacks/favours from vendors (9%), violation of Code of Conduct (53%) and non-Code of Conduct-related (38%). The financial impact of these cases was insignificant and caused no damage to Ambuja Cement.

We have a vigil mechanism for disclosure and for avoiding conflict of interest in all our dealings, covering the Board of Directors and all employees across levels.

A more detailed review can be found in the Corporate Governance Report, forming part of this Integrated Report

Prevention of Sexual Harassment (POSH)

We have laid out a comprehensive POSH policy in the organisation, headed by the Chief Financial Officer (CFO) and have ‘Zero Tolerance’ towards any misconduct. Any reported incident is investigated with due importance and appropriate decisions are taken based on the outcome of the investigation. During the year under review, we received two POSH related complaints and both have been resolved.

Investor grievance

The Stakeholder’s Relationship Committee is responsible for managing investor grievances, along with the registrar and share transfer agent of Ambuja Cement. We had no pending complaints at the beginning of the year; and received 21 new complaints during the year. At the end of the reporting period, all complaints were addressed. Based on the nature of the queries/ complaints, we usually take seven days to a month to resolve investors’ complaints.