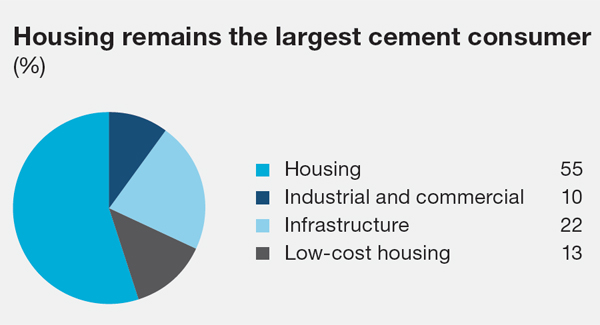

We expect that the following factors will be among the key growth drivers of cement in India:

Housing for all

The Pradhan Mantri Awas Yojana (PMAY) was launched in 2015 to provide housing for all by 2022. Under the scheme, ~10 million houses were sanctioned in the urban area, of which ~4.2 million houses were completed (as on January 25, 2021).

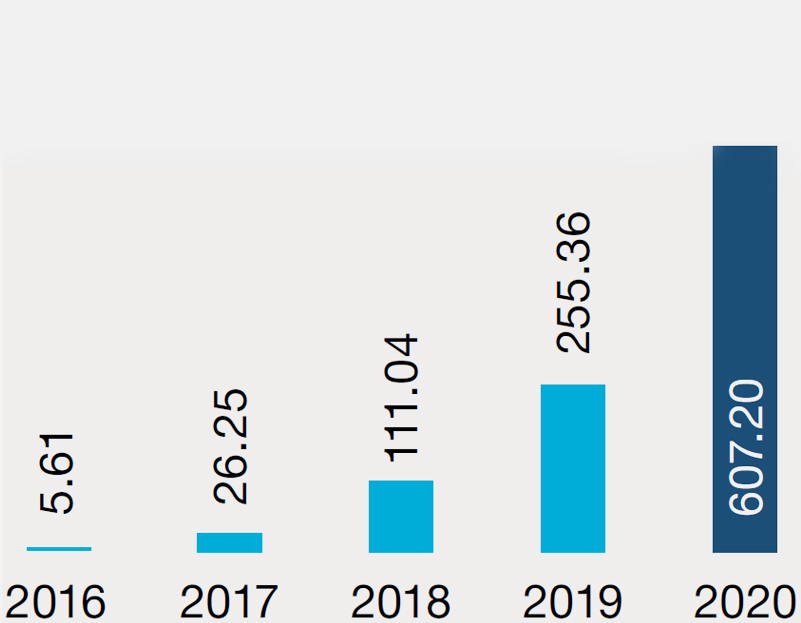

Cement consumption in grounded houses

(Lakh metric tonnes)

(Source: pmay-urban.gov.in)

Credit Linked Subsidy Scheme (CLSS)

The central government has extended the CLSS for the affordable housing segment from March 2020 to March 2021, with a direction to drive the segment.

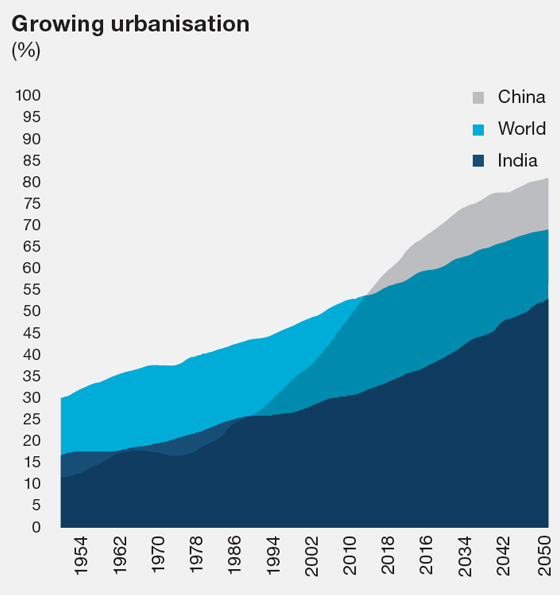

Faster urbanisation

It is expected that 40% of the population, or 600 million people, will be residing in urban areas by 2030, requiring 700-900 million square metres of residential and commercial space to be built every year till 2030

(Source: m.economictimes.com/news/economy/infrastructure/ how-india-isbuilding-cities-of-the-future/articleshow/69964522. cms?_oref=cook).

(Source: Knight Frank)

Demography

India has the second largest population with 62% in the working age group of 15-59 years, and more than 54% is under the age of 25 years. The young population is likely to drive demand for real estate in the country.

Nuclearisation

The average household size in India has declined from

5.3 members in 2011 to 4.6 members in 2019. Nuclearisation

is further expected to add ~6-7 million households

per year.

Focused on highways

The Centre has earmarked a `2.02-lakh crore investment plan to build highways in the next nancial year 2021-22. This along with increasing focus on road concretisation will drive demand for cement.

National Infrastructure Pipeline (NIP)

The National Infrastructure Pipeline aims to invest `111 lakh crores by 2025 in multiple projects spanning transport, energy, social and commercial infrastructure, communication, water and sanitation, among others.

Rural income

Increased Minimum Support Price (MSP) as well as allocation for various projects are helping support farming income and rural economy. Enhanced allocation of funds for the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) is also helping enhance rural income.