investment case

Setting us apart

Solid macro and market fundamentals

- Stable government and progressive economic policies to drive strong Gross Domestic Product (GDP) growth of ~7.0% per annum in medium to long term

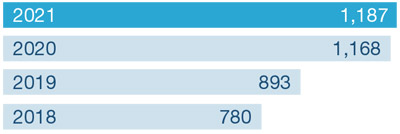

- India is a high growth attractive cement market, with a low annual per capita consumption of ~242 kg against a global average of 525 kg

- Rising urbanisation is expected to reach 40% by 2030 – additional 113 million people in cities by 2030 (Source: Fitch Solutions; United Nations report on World Urbanization Prospects 2018)

- Indian cement industry scores high on sustainability metrics

Source: CRISIL Research

Robust financials

- Superior operating performance has helped strengthen financial performance

- Net sales for the year stood at `13,794 crore while operating EBITDA stood at `3,207 crore

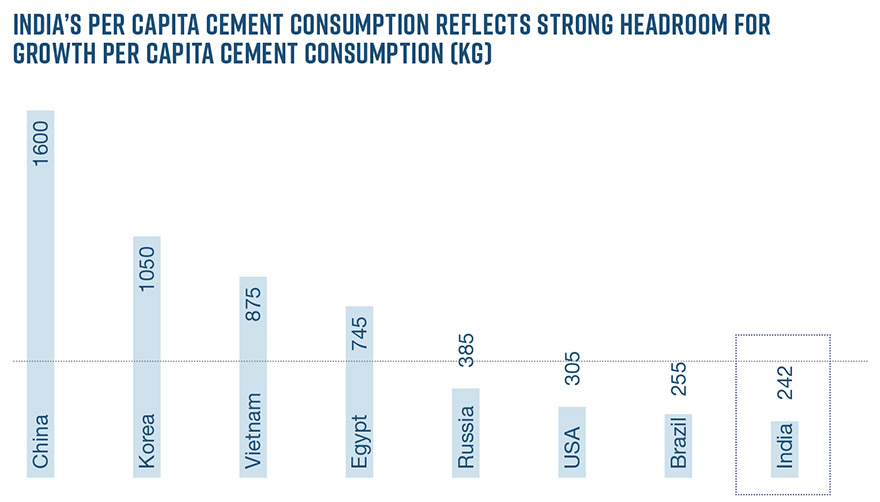

- Reported a strong RoCE of 13.10%

- Debt-free balance sheet with cash and liquid investments of `3,985 crore

- `1,251 crore proposed dividend for the year

Return on capital employed (%)

Sustainability leadership

- Enhancing share of green power in overall portfolio through significant investments in Waste Heat Recovery System (WHRS) and solar power plants

- Aligned with Holcim’s sustainability commitment of becoming a Net Zero company with focus on climate change, water consumption, circular economy and community development

- Developed and validated our 2030 carbon emission reduction targets by the Science Based Targets initiative (SBTi)

- The SBTi has classified our scope 1 and 2 target ambition and has determined that it is in line with a well-below 2°C trajectory.

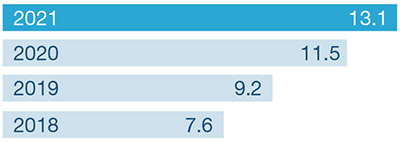

Water consumed in cement operations and recycled (Mn m3)

Expansion road map in place

- Commissioning of Marwar integrated plant helped increase our clinker capacity by 3 MTPA and cement manufacturing by 1.8 MTPA

- Brownfield expansion of 1.5 MTPA at Ropar in Punjab by 2023

- Further expansions are planned in Eastern and Western India with various debottlenecking initiatives to reach a capacity of 50 mn tonnes in mid-term

Enriching product portfolio

- Our wide portfolio of trusted brands span across diverse cement and concrete categories comprising more than 89% of blended cements; suited to various climatic conditions, the products meet the diverse needs of our customers

- Extended the portfolio to include other sustainable and innovative building materials

12%

Share of premium products as percentage of total sales

Enhancing efficiency

- Increasing operational efficiency through the implementation of digital tools and automation across plants

- Leveraging Master Supply Agreement with ACC and improving profitability

- Undertaking important cost optimisation initiatives in the areas of captive fuel security and rail infrastructure

- Use of technology in logistics helping optimise operating cost

EBITDA per tonne of cement (`)