Effective financial capital management is crucial for meeting our business objectives, preserving stakeholder value, and ensuring uninterrupted operations. Our financial capital encompasses the surplus generated from our core business activities and funds acquired through financing endeavours, such as debt and equity raising in accordance with market conditions.

Stakeholders impacted

Stakeholders and investors

Employees

Dealers

Suppliers

Community and NGOs

Material issues addressed

- Marketing communication and reputation

- Economic performance

- Procurement practices

Key risks addressed

- Maintaining market position

- Funding requirements

SDGs impacted

Capital-wise performance > Financial Capital

Overview

While cement demand remained robust, the year saw challenges in terms of rising input prices and high energy prices, impacting profitability. We reported strong growth in volumes during the reporting period.

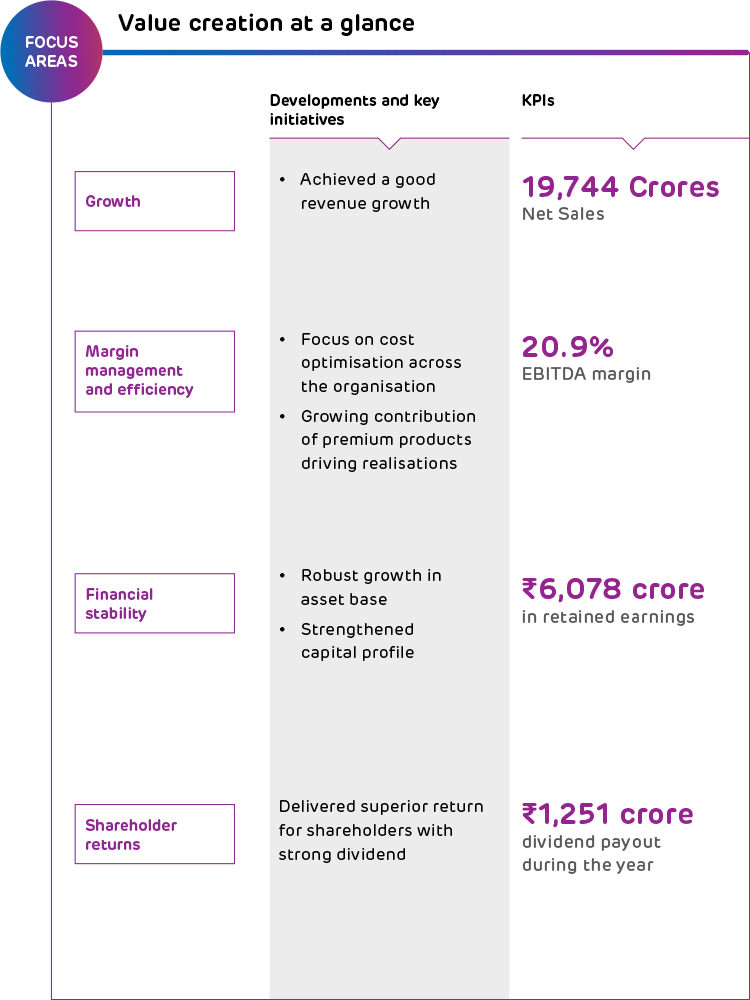

Growth

During the year, we reported net sales of `19,744 crore. Performance was driven by a strong demand, which led to 86.4% capacity utilisation as well as continued focus on the premium category, resulting in average realisations of `5,226 per tonne.

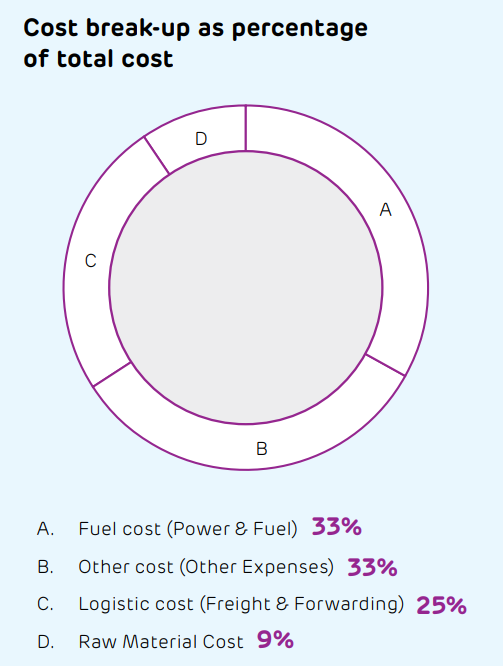

Margin and efficiency

Despite a substantial increase in input prices during the year, our relentless efforts towards cost rationalisation helped us report an EBITDA of `4,173 crore. EBITDA margin for the reporting period stood at 20.9%.

In the face of an inflationary environment, we were able to restrict growth in the total cost of operation owing to the increased use of energy from WHRS, the replacement of imported coal with domestic coal and various improvement and cost optimisation initiatives undertaken in logistics.

Earnings

Our pre-tax profit stood at `3,055 crore. Pre-tax profit margin stood at 15.3%.

Robust earnings resulted `502 crore in tax outgo with an effective tax rate of 16.4% in 2022-23.

Our net profit for the year stood at `2,553 crore. Net profit margin for the year stood at 12.8%.

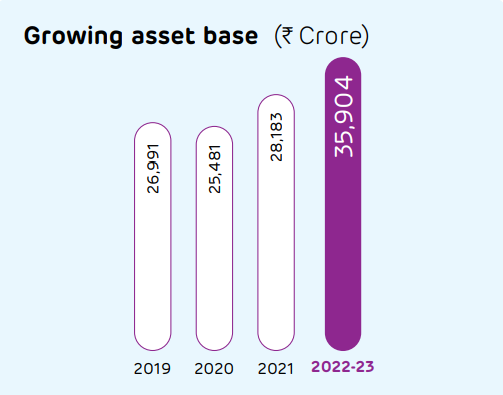

Assets

Our total assets reported stood at `35,904 crore. Current assets accounted for 31.3% of the total assets during the period under review.

Our funding profile strengthened further during the year based on a strong profit generation that boosted the Company’s equity base. We continue to remain long-term debt free.

Cash flow

Our cash flow position strengthened during the year, reflecting the broad-based improvement in operational performance, which increased operating cash flow. Net cash from operations stood at H2,010 crore, supported by strong cash flow generation on the back of increased activity levels and effective working capital management.

CRISIL AAA/Stable/CRISIL A1+