Ambuja Cement has a well embedded business

risk management process for identifying risks and

opportunities on corporate as well as operational

levels. The overall objective is to improve

awareness of the Company’s risk exposure and

appropriately manage it. Materiality reviews are

being conducted in conjunction with the annual

business planning cycle.

Risk assessment and management policy support

the sustainable business module for increased

profitability. Our risk management approach

incorporates sustainability and provides

management with useful data for identifying

emerging issues and developing new and better

products and processes that help protect corporate

reputation and improve shareholder value.

Sustainability gives us an opportunity to look at

risks in a broader than a traditional risk

management framework, which is to look beyond

economic, strategic and operational factors and

to include social and environmental considerations.

Sustainability allows corporations to consider

emerging risk areas and to look for opportunities

presented by risks that are overlooked by other

analytical and systems-driven approaches. A more

holistic point of view assures sound financial

management, ethical corporate governance and

transparency with respect to information provided to

employees and other stakeholders profitability.

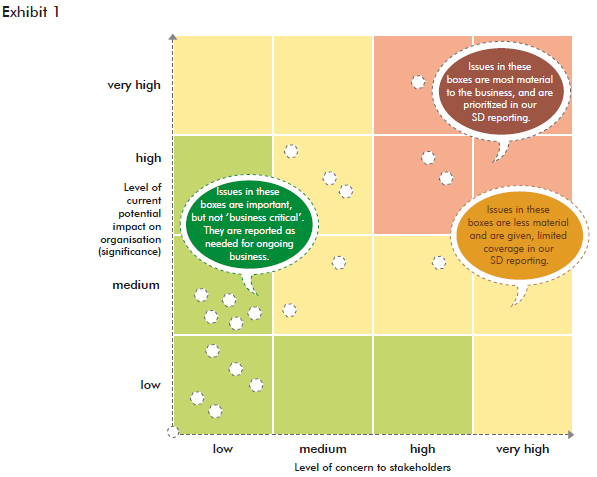

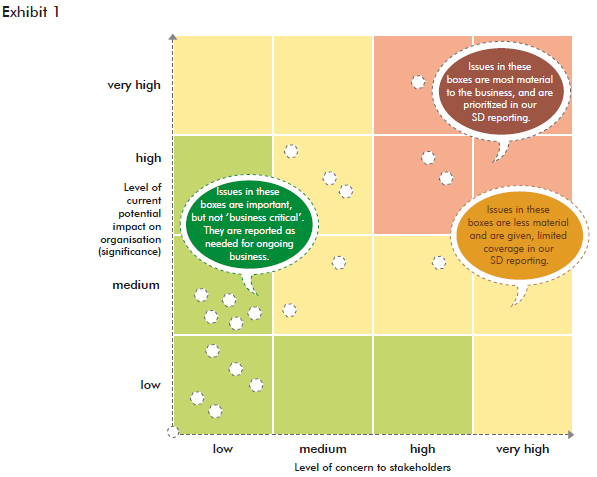

ACL’S SUSTAINABILITY RISKS/OPPORTUNITIES ASSESSMENT 2013

|

| Our risk management approach

incorporates sustainability and provides

management with useful data for identifying

emerging issues and developing new and better

products and processes that help protect corporate

reputation and improve shareholder value.

Sustainability gives us an opportunity to look at

risks in a broader than a traditional risk

management framework, which is to look beyond

economic, strategic and operational factors and

to include social and environmental considerations.

Sustainability allows corporations to consider

emerging risk areas and to look for opportunities

presented by risks that are overlooked by other

analytical and systems-driven approaches. A more

holistic point of view assures sound financial

management, ethical corporate governance and

transparency with respect to information provided to

employees and other stakeholders.

Examples of emerging issues of concern in the

sustainability area for our industry include climate

change, social justice, depletion of non-renewable

resources, brand damage (including boycotts),

shareholder actions related to sustainability issues

and disclosure of historic environmental liabilities.

Sustainability Risk Management also requires the

evaluation of many aspects of the entity’s

operations that are not part of most current

corporate programs. |