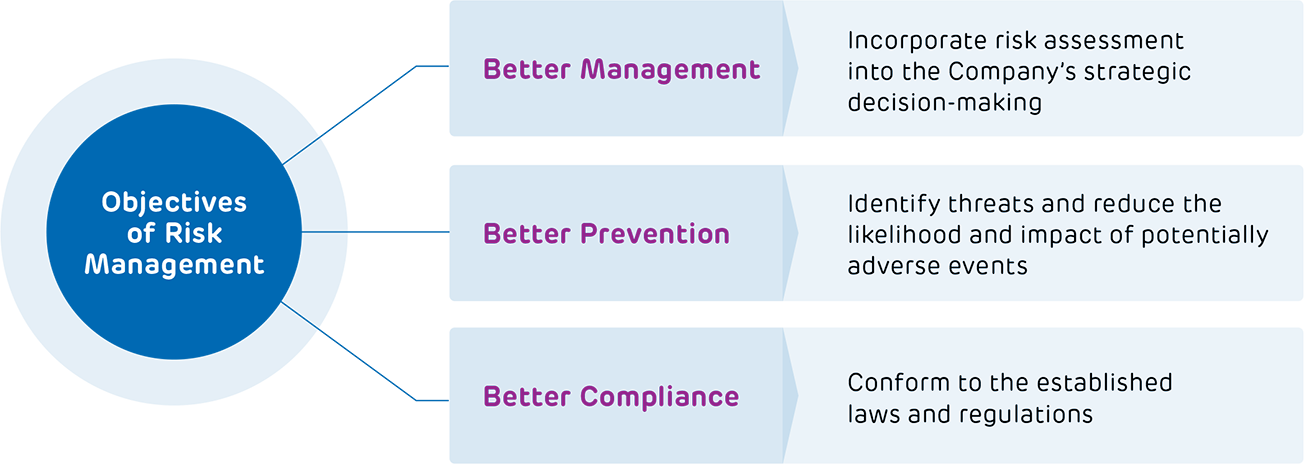

Ambuja Cements implemented a comprehensive Enterprise Risk Management (ERM) process to identify, assess, and mitigate risks associated with its operations. It also helps identify variables that could internally and externally impact the Company.

Risk Management Process

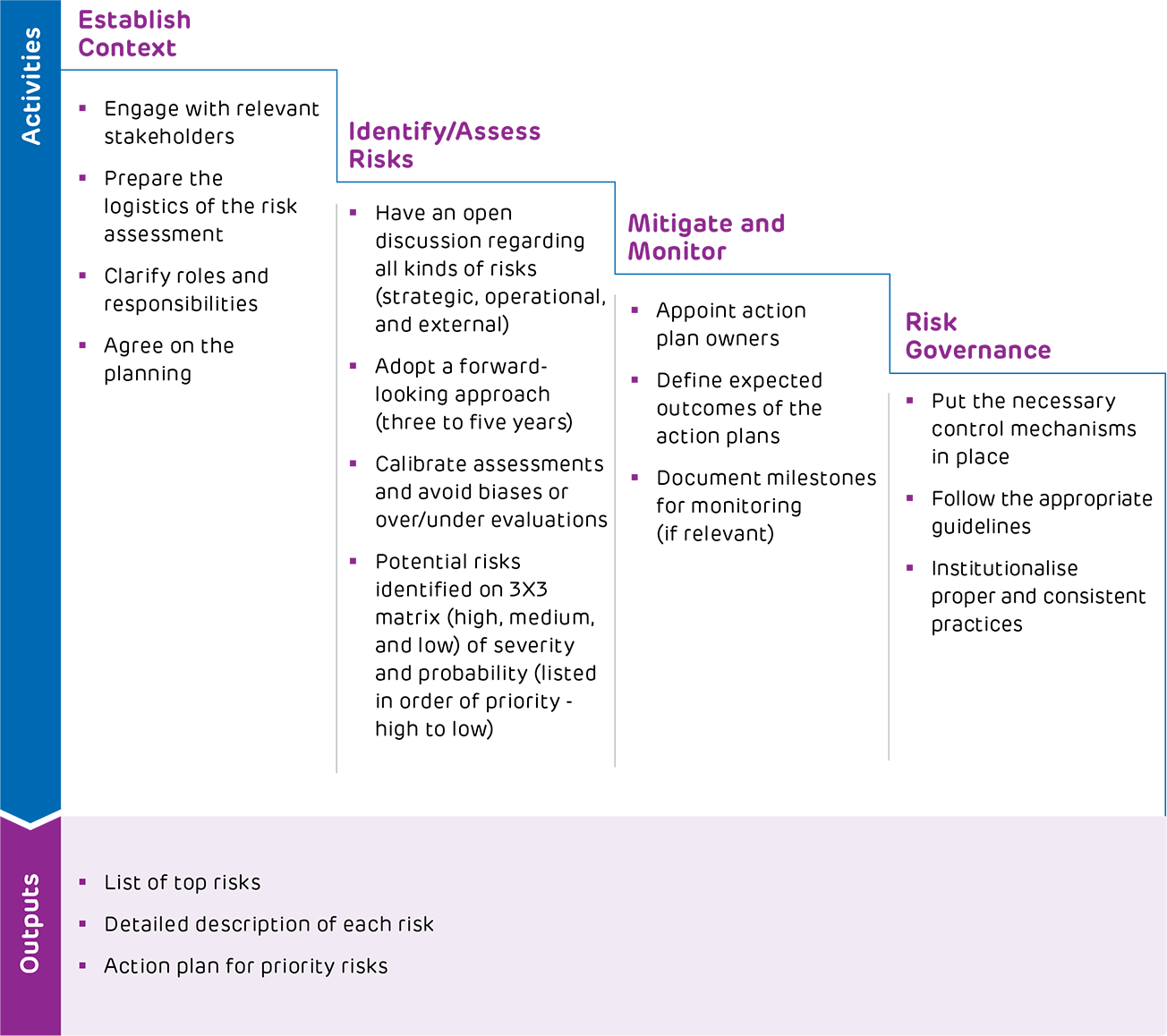

The Company follows a strategic process involving risk maps, business environment scanning, and assessments. Potential risks are identified based on severity and probability on a 3X3 matrix (high, medium, and low).

It takes a functional approach, where each department assesses its current and future scope, identifying potential risks and opportunities. The Company consolidates these risks, providing an organisation-wide overview.

Ambuja Cements formulates effective mitigation plans for identified critical risks, and the senior management closely monitors the intensity of the risks in its operations. Throughout, the Company ensures strict controls for effective operations and regulatory compliance.

Risk Management Framework

Enterprise Risk Management is an integral part of the Adani Group Policy Landscape, wherein risks are evaluated in an unbiased way and managed in a structured approach with the support of various corporate functions to ensure that all significant risks are identified, assessed, prioritised, mitigated, monitored, and reported.

Risk Governance

Ambuja Cements provides a comprehensive view of both internal and external risks, aligning with its defined risk appetite and tolerance. Through a robust risk assessment process, consistently applied across the organisation, the Company empowers management to identify, evaluate, and mitigate risks while ensuring regulatory compliance and operational efficiency.

Risk governance is central to Ambuja Cements' approach, fostering a holistic view and enabling strategic responses based on risk ratings and the overall risk appetite. Quarterly reporting to the Risk Management Committee, led by the CEO and CFO, ensures transparency and accountability. The Company employs a top- down and bottom-up approach to assess risks and opportunities, culminating in a consolidated overview of the organisation.

The Risk Management Committee of the Board oversees the adequacy of the ERM process and monitors the progress of mitigation actions. By focusing on a maximum of two risks in each meeting, the Company ensures a dedicated and clear-sighted approach to addressing issues and implementing actionable solutions. This focused governance strategy strengthens its ability to adapt and thrive in the face of foreseeable risks, safeguarding its business and promoting sustainable growth.

Risk Management Committee

Under the Company’s comprehensive risk management framework, the Risk Management Committee is constituted with 50% Independent Directors to monitor, report, and mitigate various risks faced continuously. It reviews the Company’s risk governance structure, risk assessment, risk management policies, practices, guidelines and procedures, and the risk management plan.

The committee is constituted in accordance with applicable provisions of the Companies Act, 2013. It directly reports to the Board of Directors and assists them in fulfilling its responsibilities regarding the Company’s risk management framework and governance structure that supports it. The committee has four sub-committees to support its responsibilities.

Commodity Price Risk Committee

This sub-committee supports the Risk Management Committee in reviewing the risks associated with the Company's commodity price exposures while promoting risk awareness and code of conduct. It devises the Commodity Price Risk Management (CPRM) policy and reviews it according to market conditions.

Reputation Risk Committee

It supports the Risk Management Committee in reviewing the risks associated with the reputation of the Company, promoting the culture of risk awareness, and maintaining high standards of culture and conduct. It assesses and resolves specific issues and ensures reporting of potential conflicts of interest and other reputation risk issues to the Risk Management Committee.

Risks Identified for FY 2023-24

Risks

Maintaining Market Position in a Dynamic Industry Environment

Description

The Indian cement industry's ever-evolving diverse landscape poses inherent risks to the Company’s market position, heightened by ongoing capacity additions and consolidations.

Mitigation

Ambuja Cements counters these risks through an ambitious plan, targeting a total capacity of 140 MTPA by FY 2027-28. Recent achievements include a significant increase in total capacity by approximately 10 MTPA, strategically enhancing its market presence. Additionally, proactive efforts in brand equity enhancement through innovation and digitisation ensure resilience against competitive and profitability challenges.

Risks

Compliance with Changes in Regulatory Landscape

Description

Regulatory changes, driven by shifts in climate and environmental concerns, are occurring rapidly worldwide. Failure to comply with these new standards poses a high degree of complexity, potentially impacting the reputation and financial standing of the Company.

Mitigation

The Company employs transformation, upgradation, and modification tools to address these challenges. It has initiated various projects across its operations to control pollution and adhere to new emission standards (for dust, SOx, and NOx) set by the Ministry of Environment, Forest and Climate Change, Government of India. Government of India. This proactive approach ensures regulatory compliance and positions the Company as a responsible steward of the environment.

Risks

Health and Safety Priorities

Description

Health and safety are fundamental to the business sustainability, demanding teamwork, and commitment at all levels. In the pursuit of Zero Harm, the Company is undergoing evaluations and is focused on improving frontline safety and leadership presence.

Mitigation

The Company systematically reviews systems, processes, and procedures, addressing identified gaps. Initiatives including Unchaai Kendra and Life Saving Safety Rules enhance awareness and prevent mishaps, contributing to a safer working environment onsite and offsite. Regular dynamic risk assessments help the Company to stay ahead of challenges, driving continuous progress towards 'Zero Harm.'

Risks

Fuel and Raw Material Security Challenges

The cement industry, known for its capital, energy, and raw-material intensity, grapples with significant challenges in ensuring fuel and raw material security. Operating expenses hinge on energy and raw material costs, necessitating an uninterrupted supply for business continuity.

Ambuja Cements employs a comprehensive strategy to address these challenges. It optimises the fuel mix for fuel security, enhances plant efficiency, and increases alternative fuel utilisation. Significant investments in green energy initiatives, like Waste Heat Recovery Systems (WHRS) and solar power, contribute to a sustainable and diverse energy supply.

Procuring raw materials, including coal, limestone, and fly ash, at an economical cost and suitable quality is crucial for production efficiency. Challenges arise from the Mines and Minerals (Development and Regulation) Act's notification, mandating mining lease renewals and grants through auctions, leading to fierce competition. The Company proactively secures its future by identifying suitable blocks for acquisition through auctions, ensuring sustained raw material security alongside current reserves that guarantee an uninterrupted limestone supply.

Risks

Cybersecurity Threats

Ambuja Cements' strategic integration of digitisation and emerging technologies, spanning artificial intelligence (AI), the Internet of Things (IoT), and data availability, brings forth avenues for its progress and introduces new risks. The rapid pace of technological evolution presents both opportunities and potential security challenges.

The Company proactively addresses the potential security risks associated with tools like ChatGPT, Google Bard, and social media platforms. It has implemented immediate measures to safeguard confidential information, including identifying and blocking data leakage sites that threaten the Company’s network. Simultaneously, plans are in motion to establish a secure and monitored environment dedicated to using AI-based tools.

Creating a secure business environment involves the implementation of backup procedures and firewalls. Regular system upgrades and monitoring adhere to the latest security standards. Ambuja Cements' commitment to cybersecurity extends to the periodic update of policies and procedures, ensuring alignment with the evolving threat landscape. Users are consistently educated on policy adherence, eliminating risks, and contributing to a secure digital workspace at Ambuja Cements.

Risks

Climate Risk

The Company is conscious of the physical and transitional climate change risks. In physical risks, Ambuja Cements considers acute (flooding, droughts, etc.) and chronic risks (water stress, heat stress, etc.), and in transitional risks, it considers regulatory, technology, market, and reputation risks. It can cause supply chain disruptions and power outages.

The Company has in place a well-established climate governance in place consisting of policies and committees. Climate related metrics and targets are defined, and performance is regularly monitored. The structures are designed to withstand severe conditions. Emergency plans are in place to address the risks. Regular trainings and drills are conducted to ensure that everyone is familiar with emergency procedures.

Risks

Natural Resources

The cement industry predominantly relies on natural resources like limestone, coal, and minerals. Ensuring the availability of these materials while maintaining optimal cost and quality standards is imperative for seamless business operations.

To mitigate risks associated with natural resources, Ambuja Cements is investing in improving its operational efficiency for better resource utilisation. The Company is undertaking several initiatives to conserve resources through efforts to improve the clinker factor and thermal substitution rate, among others. Additionally, the Company is investing in renewable energy and WHRS systems to minimise its reliance on non-renewable sources. To ensure the availability of raw materials, the Company is also investing in coal and limestone mines.

Risks

Energy Security

Energy security is a critical factor for Ambuja Cements, as it heavily influences both operations as well as overall production cost. Given the energy-intensive nature of cement production, particularly during kilning and grinding processes, managing energy costs effectively is paramount.

Cognisant of the importance of safeguarding against the risk of energy price inflation, the Company diversifies its fuel sources, which includes leveraging alternative fuels. This approach helps mitigate the impact of fluctuating energy prices by reducing reliance on conventional fossil fuels. Moreover, Ambuja Cements evaluates various energy procurement options to ensure optimal cost-effectiveness. The Company enhances energy efficiency across its value chain through innovative technologies and sustainable practices. By managing its energy resources, the Company aims to sustain competitiveness in the dynamic cement industry landscape.

Risks

Project Execution

Project execution is critical, considering the Company's vision to reach 140 MTPA by FY 2027-28. In line with this target, the Company is already executing large-scale projects at multiple sites. To ensure timely completion, with utmost safety and quality and all within budget, is of utmost priority for the business.

The Company is leveraging group synergies by aligning with the Adani Group’s project management company which has demonstrable experience and expertise in executing largescale projects. Budgetary concerns, an important factor in project execution, are mitigated by a robust cashflow through internal accruals. The Company is executing its ongoing projects primarily through EPC mode, for which it is partnering with the most reputed and regarded suppliers in the world. The Company is aligning its internal processes with an objective of simplifying, standardisation, and skill enhancement to achieve maximum speed and scale – the Projects team’s 5S mantra.