*Comparable PAT excludes all one-time items like regulatory income, provisions, bilateral charges

Note 1: Growth pertains to growth in FY 2023-24 vs FY 2022-23

Note 2: Adjusted EBITDA: PAT incl. Share of Profit from JV + Current Tax + Deferred Tax +

Depreciation + Finance Cost + Unrealised Forex Loss / (Gain) + Exceptional Items

Note 3: EBITDA and PAT of AWL was impacted on account of hedges dis-alignment, tariff rate

quota disparity and losses in Bangladesh operations

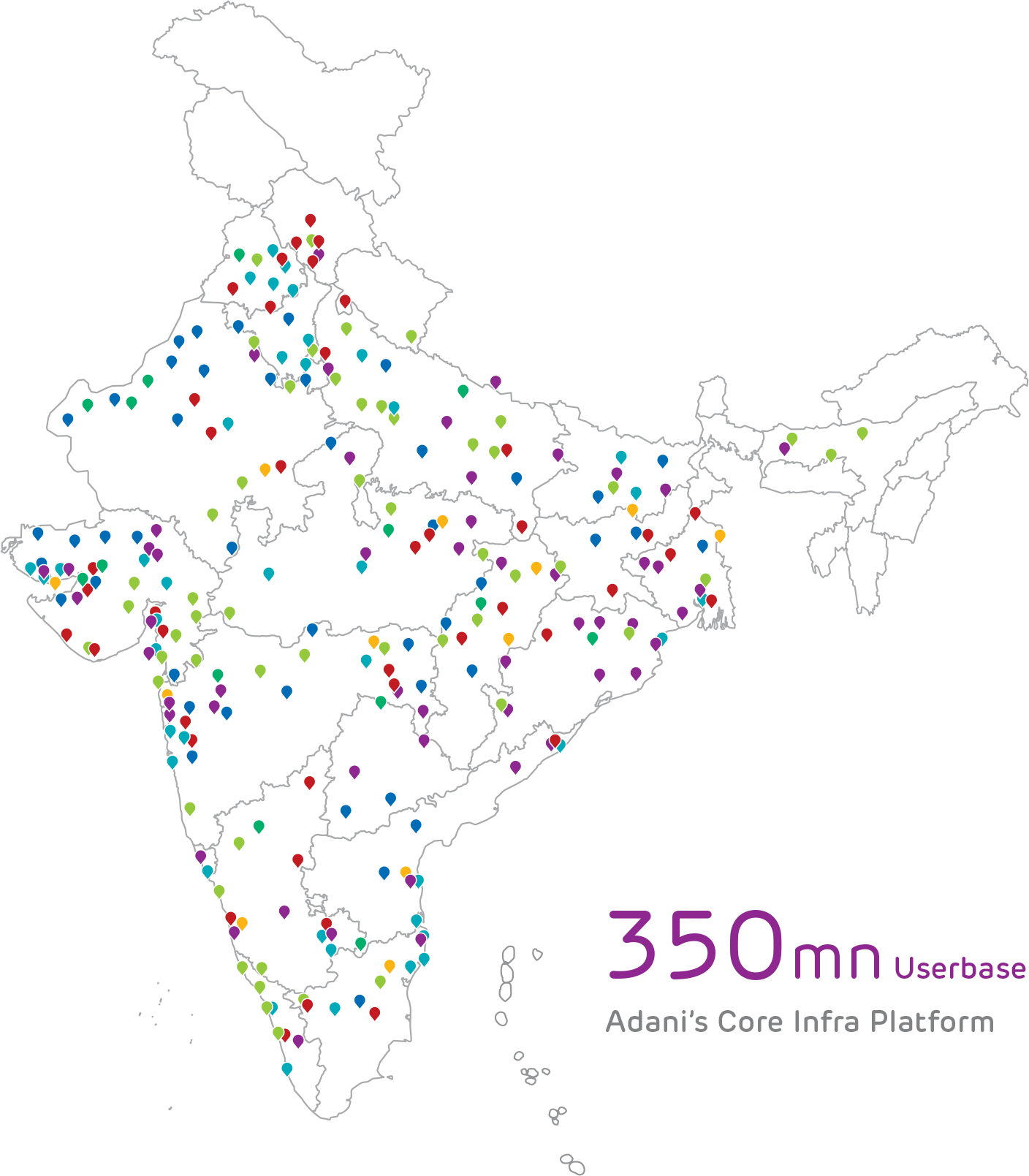

Ambuja Cements Limited is one of the leading players in the Indian cement and building materials industry and an integral part of the Adani Group. With recent acquisitions, and greenfield and brownfield expansions, Adani Group’s cement capacity stands at 78.9 MTPA, spread across 43 cement manufacturing facilities, including 18 integrated plants. The Company aspires to contribute to the country’s growth agenda through its portfolio of products and solutions that ensure hassle-free and eco-friendly construction.

Recognised as India’s first water-positive cement company and among the most sustainable companies across industries, Ambuja Cements prioritises building a sustainable and equitable world for future generations.

Read moreNet Zero Commitment

by 2050 with near-term (2030) validated targets

Renewable and Green Energy

19.1% renewable and green energy used

Circular Economy

8.6 million tonnes of waste derived resources used

Carbon Emission

Scope 1: 559 kg/tonne of cementitious material

Water-positive

Ambuja is 11x water-positive

Plastic Negative

Ambuja is 8x plastic negative

Trees Planted

1.4 Mn trees planted till FY 2023-24

Clinker Factor

64.3%

CSR Beneficiaries

3.27 million till FY 2023-24

CSR Spent

` 51 crore

Local Sourcing of Raw Material

93% from within India

Training Hours

22 training hours per employee

Independent Directors

100% Board committees chaired by Independent Directors

Data Security

Zero complaints

Anti-bribery and Anti-corruption

Zero complaints

Ethics and Integrity

Zero complaints

At the heart of this Portfolio of Progress is a journey of evolution over the years. Like the ascending peaks of a mountain range, we have grown every year – not only on the strength of our business performance, but equally and importantly, through our steadfast commitment to environmental, social and governance practices underpinned by a culture of transparency.

Monumental success is not merely about reaching new heights but shattering

previous boundaries and redefining what is possible.

Ambuja Cements' strategic imperatives propel its journey to maintain and elevate its leadership stature, amplify its scale, foster innovation, preserve the environment, and uplift communities toward a future marked by progress and prosperity.

Read MoreResource Allocation in FY 2023-24

Including organic and

inorganic growth Capex/

Investment

Environment related

expenses

With a strategic emphasis on sustainability, Ambuja Cements seamlessly integrates social and environmental considerations into its operations, gaining a distinctive competitive advantage.

Read MoreThe Indian economy continues to demonstrate resilience amid global headwinds. India’s continued outperformance vis-à-vis major global economies reflects the economy’s structural strength and ability to absorb external shocks.

Read More