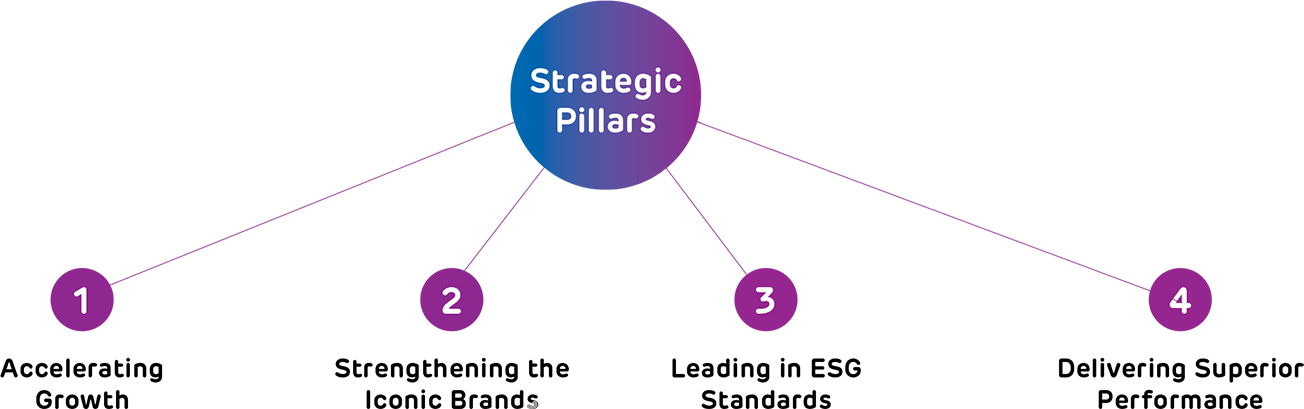

Ambuja Cements' strategic imperatives propel its journey to maintain and elevate its leadership stature, amplify its scale, foster innovation, preserve the environment, and uplift communities toward a future marked by progress and prosperity.

1

Accelerating Growth

Focus Areas

Strengthen market position through capacity expansion – greenfield and brownfield

Resource Allocation in FY 2023-24

Including organic and inorganic growth Capex/ Investment

Linkages to Material Issues

- Economic performance

- Sustainable development

Key Risks Impacting Strategy

- Elevated global energy prices and supply chain disruptions

- Delay in projects commissioning

- Ambitious plans to increase cement capacity to 140 MTPA by 2028

- 2.25 MTPA capacity addition through organic route

- 9.1 MTPA capacity addition through inorganic route (includes 1.5 MTPA of Tuticorin Grinding Unit)

- Ongoing cement capacity expansion of 20 MTPA across the nation

- Increasing network and market presence

2

Strengthening the Iconic Brands

Focus Areas

Reinforce and maximise Brand values of Ambuja Cements towards nation building

Resource Allocation in FY 2023-24

- Sustained investments in Iconic Brands

- Deliver superior Customer Experience

Linkages to Material Issues

- Customer satisfaction

- Sustainable construction

Key Risks Impacting Strategy

- Product innovation

- Market acceptance

- Latest brand campaigns created significant impact

- Brand association with leading sports leagues for nationbuilding through sports

- Lead Cement supplier in India’s longest sea-bridge, Atal Bihari Vajpayee Sewri-Nhava Sheva Atal Setu

- Strong presence of 1,00,000+ channel partners

- Pan-India presence of the Company’s technical services with 1,000+ civil engineers

- Reaching out to 7.5 lakhs IHB customers

- Connected with 5.5 lakhs Architects, Engineers and Contractors

3

Leading in ESG Standards

Focus Areas

Reinforcing leadership by conducting its business responsibly, sustainably, and inclusively and introducing greener products

Resource Allocation in FY 2023-24

Environment related expenses

Linkages to Material Issues

- Greenhouse gas emissions and climate change

- Energy consumption

- Air emissions

- Circular economy and waste management

- Alternative fuels and resources

- Water consumption

- Biodiversity

- Corporate Social Responsibility

Key Risks Impacting Strategy

- Climate change

- Policies and regulations

- Product responsibility

- Local communities

- Investment of ` 10,000 crore to increase the Company’s green power share to 60% of the 140 MTPA planned capacity

- Established leadership in water governance with 11x water positivity

- Committed to achieving net zero by 2050, with near-term targets validated by SBTi

- Creating societal value for more than 3.5 million people by 2030

- 8x plastic negative by co-processing of plastic waste

- Committed to planting 2.42 million trees by 2030, following the Group’s plan to plant 100 million trees

- Embracing the circular economy, harnessing alternative fuels and raw materials with Thermal Substitution Rate (TSR) of 27% by 2030

4

Delivering Superior Performance

Focus Areas

Getting the most out of its existing portfolio through premiumisation, cost efficiency, volatility management, skill-building and digitalisation of systems and processes

Reduction of cost by E 473 per tonne during FY 2023-24. The target is to reduce it by an additional E 530 per tonne by FY 2027-28

Linkages to Material Issues

- Economic performance

- Attraction and retention of talent

Key Risks Impacting Strategy

- Inflation

- Cybersecurity

- Employee retention

- Share of premium products and revenue increase by 30 BPS

- Increasing process efficiencies and synergies

- Cost optimisation

- 22 man-hours of training provided per employee for employee development

- Digitisation is a significant multiplier to the growth strategy of Ambuja Cements, transforming its entire value chain, from quarry to lorry through cutting-edge technologies and applications - Industry 4.0, AI, Mobile platforms, GPS, Data and Analytics, etc.

- State-of-the-art Cement and Concrete R&D facility with a focus on new product development