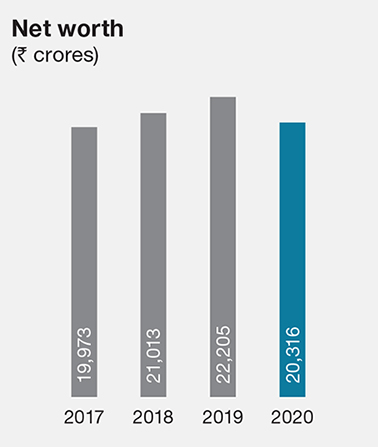

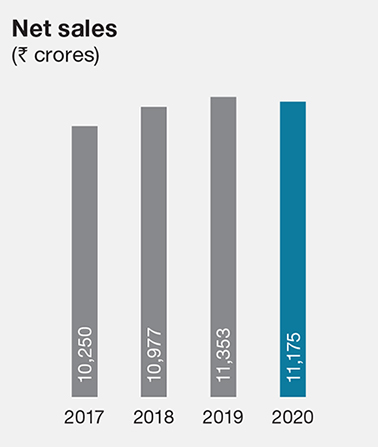

Ambuja Cement’s robust liquidity position was by design and not chance. It is the result of daily application of the

spirit – going the extra mile, and identifying opportunities, especially in a crisis.

COVID-19 presented a multi-pronged challenge. Generating and protecting cash was one of them.

Working capital woes could potentially impact business continuity, if not resolved expediently. We got to work, with urgency, and a solution-centric approach.

With little time on hand, meant action had to happen at the speed of thought.

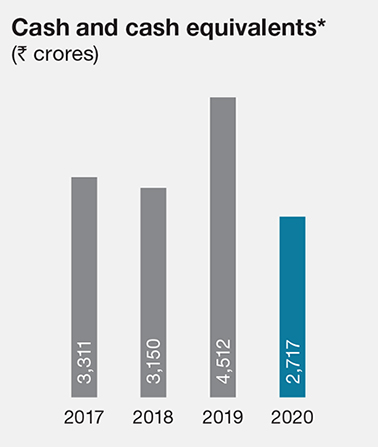

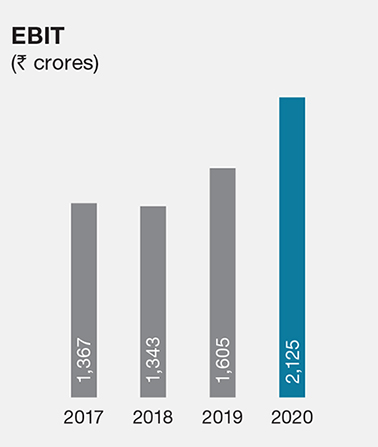

We quickly developed a cash dashboard that allowed us to track daily liquidity scenarios. Next, we initiated steps to shorten inventory cycles and rigorously followed up on payments. By doing this daily, and repeatedly, we were able to achieve faster cash conversion and reduce our daily sales outstanding. At the same time, our treasury function moved to deploy cash in highly secured instruments to protect investments. Lastly, the capex plan was reoriented to focus on critical and quick payback projects.

Keeping a tab on the

daily liquidity scenario

Inventory cycles expedited for faster capital conversion

Capital channelised on quick return projects