The Risk Management Committee of the Ambuja Board

lays down the procedures for risk assessment and

minimisation and the Board is responsible for framing,

implementing and monitoring the risk management plan of

the Company. The Committee reviewed the risk trend,

exposure and potential impact analysis carried out by the

Management. MD & CEO and CFO have confirmed that

mitigation plans have been finalised and up to date, the

owners have been identified and the progress of mitigation

actions monitored. The Committee met once during the year.

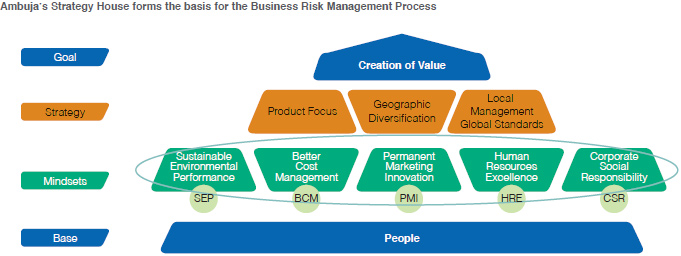

The directors or the highest governance body of the

Company also engage with the risk management process

through bodies like the Risk Management Committee, CSR

Committee & Compliance Committee. Ambuja has a well

embedded business risk management (BRM) process for

identifying risks and opportunities at corporate as well as

operational levels. The overall objective is to improve

awareness of the Company’s risk exposure and manage it

appropriately. Materiality reviews are conducted in

conjunction with the annual business planning cycle. BRM

includes assessment of social, economic, and

environmental risks. Risk assessment and Management

policy support sustainable business modules for increased

profitability. Our risk management approach incorporates

sustainability; it provides Management with useful data to

identify emerging issues and develope new and better

products and processes. These help protect the Company’s

reputation and improve shareholder value. Sustainability

gives us an opportunity to look at risks in a broader rather

than a traditional risk management framework; this entails

looking beyond economic, strategic, and operational factors

and including social and environmental considerations;

sustainability allows corporations to consider emerging risk

areas and to look for opportunities presented by risks that | are overlooked by other analytical and systems-driven

approaches. A more holistic point of view assures sound

financial management, ethical corporate governance and

transparency with respect to information provided to

employees and other stakeholders. Examples of emerging

sustainability concerns for our industry include climate

change, social justice, depletion of non-renewable resources,

brand damage (including boycotts), shareholder actions

related to sustainability issues and disclosure of historic

environmental liabilities. Sustainability risk management

also requires the evaluation of many aspects of the entity’s

operations that are not part of the most current corporate

programmes. Examples include energy consumption,

emissions of greenhouse gases, water use, waste

generation/ consumption, AFR etc. At Ambuja, we address

many aspects of sustainability, as it improves business

efficiency and boosts profits. Efficient productivity includes

reduced material requirements, reduced energy for

production, lowering of toxic gas emission, improving

recyclability, improving the durability & reliability of

products, and maximising the use of renewable resources.

Implementation of a sustainability programme starts with an

understanding of corporate and regional principles and

values. The fundamental values that unify an entity’s actions

are its way of thinking and its people; these are derived from

where the Company has been, where it is today and its

quest to continue delivering value into the future. The first

step towards implementation is risks/opportunities

assessment, where all the possible risks/opportunities are

identified and then mapped. The next step is prioritising the

risks/opportunities and formulation of action plans which then

take form of projects. One such example is the ongoing

‘Geocycle’ Project.

|